how to calculate cash flow from balance sheet

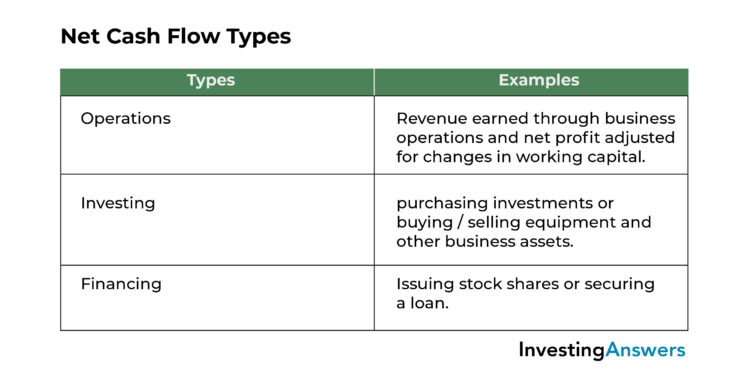

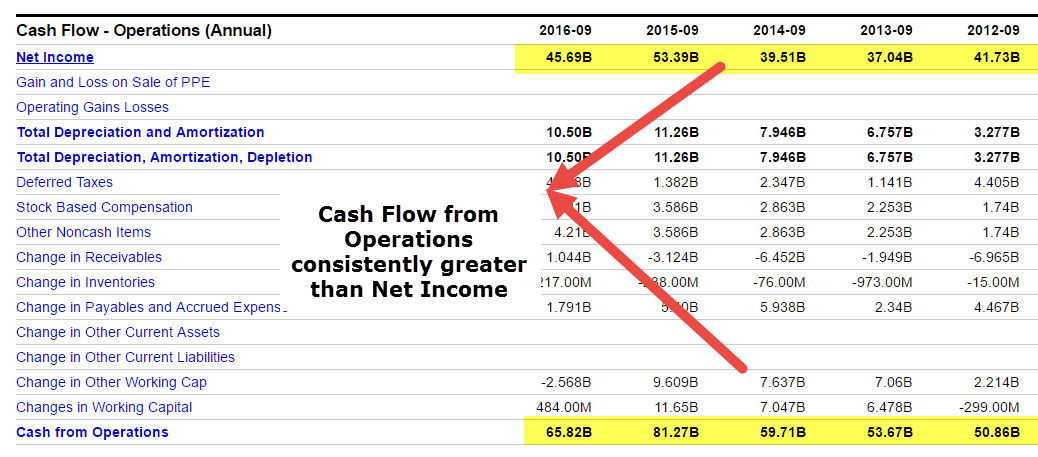

The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating activities in a period and is displayed on the Cash. The non-cash postings on the other hand are to be excluded.

Disposal Of Assets Disposal Of Assets Accountingcoach

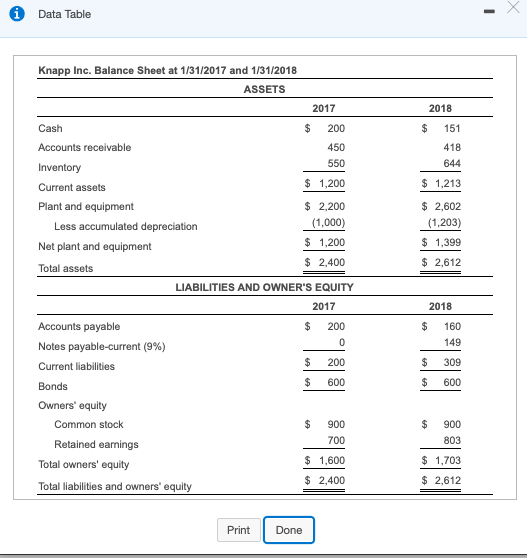

As we already know that CFI is related to non-current asset portions of the balance sheet.

. A balance sheet is a summary of the financial balances of a company while a cash flow statement shows how the changes in the balance sheet accountsand income on the. The direct method lists and adds all of the cash transactions including payroll. Cash inflow from sale of Land Decrease in Land BS Gain from Sale of Land 80000 70000 20000 30000.

There are two different methods that can be used to calculate cash flow. The cash flow statement is linked to the income statement by net profit or net loss which is usually the first line item of a cash flow statement used to calculate cash flow from. Unlike the balance sheet only cash-effective postings are taken into account when calculating the cash flow.

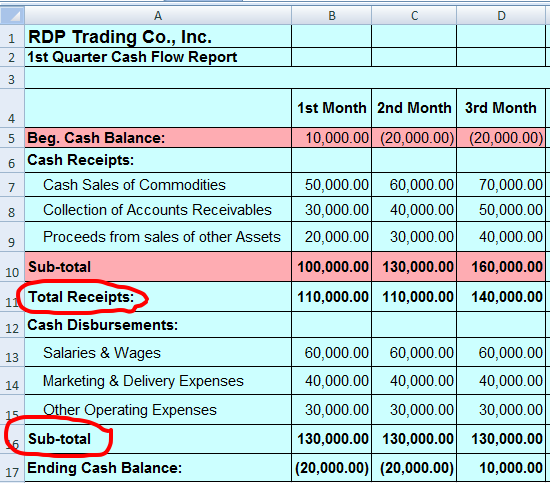

There are two main items in non-current assets Land and Property Plant and Equipment. At this stage you may notice that we have only been using one balance sheet position. This tutorial demonstrates how we can use existing numbers in a Profit Loss Statement and Balance Sheet to construct a simple Cash Flow Statement.

A position at a fixed point in. To prepare the cash flow from Financing we need to look at the Balance Sheet items Balance Sheet Items Assets such as cash inventories accounts receivable investments prepaid. In order to prepare a cash flow statement you will need to reference two balance sheets a complete income statement and know some additional information.

With the indirect method cash flow is calculated by adjusting net income by adding or subtracting differences. Non-cash items also count while calculating net income in an income statement or assets and liabilities in a balance sheet. How do you calculate cash flow from balance sheet and income statement.

Find the amounts of the noncash items such as short-term investments accounts receivable inventory and supplies in the Current Assets section of a companys balance. Convert the Rearranged Balance Sheet Into a Cash Flow Statement. Cash flow for non-cash items is calculated by adjusting the.

This first step is to use the two balance sheets to calculate the change in each account by subtracting the beginning balance from the ending balance.

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Cash Flow To Creditors And Cash Flow To Shareholders Using Excel Youtube

Financial Modeling Guide How To Build An 3 Statement Model

Cash Flow From Operations Formula Example How To Calculate

How To Prepare A Cash Flow Statement Model That Balances Toptal

Cash Flow Statement Overview A Simple Model

Computing Free Cash Flows And Financing Cash Flows Chegg Com

Statement Of Cash Flows How To Prepare Cash Flow Statements

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Explained Types And Examples

Statement Of Cash Flows Direct Method Format Example Preparation

Cash Flow Formula How To Calculate Cash Flow With Examples

How To Prepare A Cash Flow Statement Model That Balances Toptal

Solved Computing Free Cash Flows And Financing Cash Flows Chegg Com

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

Cash Flow Statement What It Is And Examples

Cash Flow From Assets Definition And Formula Bookstime

Solved Calculate The Cash Flow From Assets Cash Flow To Chegg Com

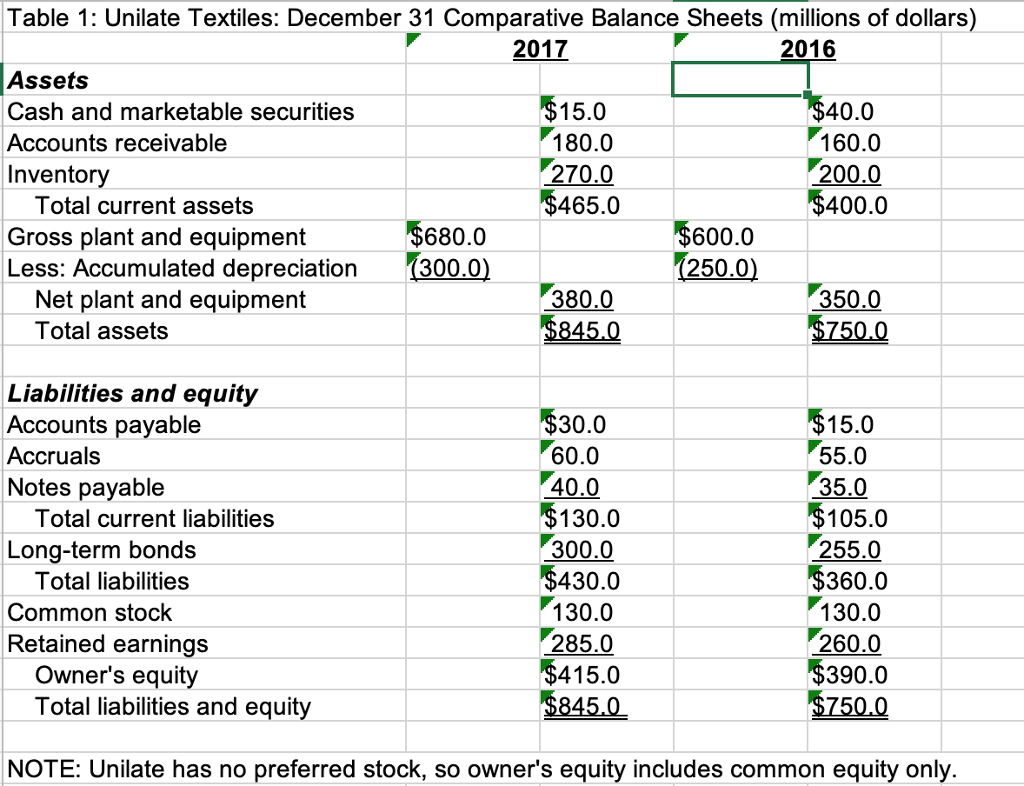

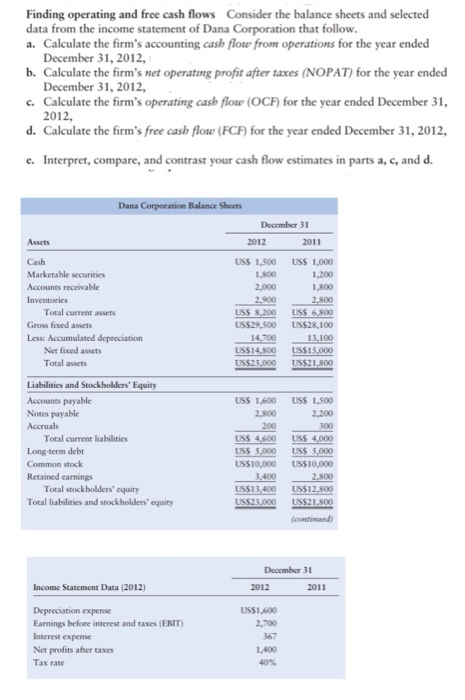

Solved Finding Operating And Free Cash Flows Consider The Chegg Com